This Too Shall Pass

Published: May 13, 2020Car dealers have justifiable pride in their ability to weather the storm and come back stronger. This time will be no different. Cars bring people together, and after this is over, we will want to be together again. Just look at the last time they counted dealers out, and how they came back.

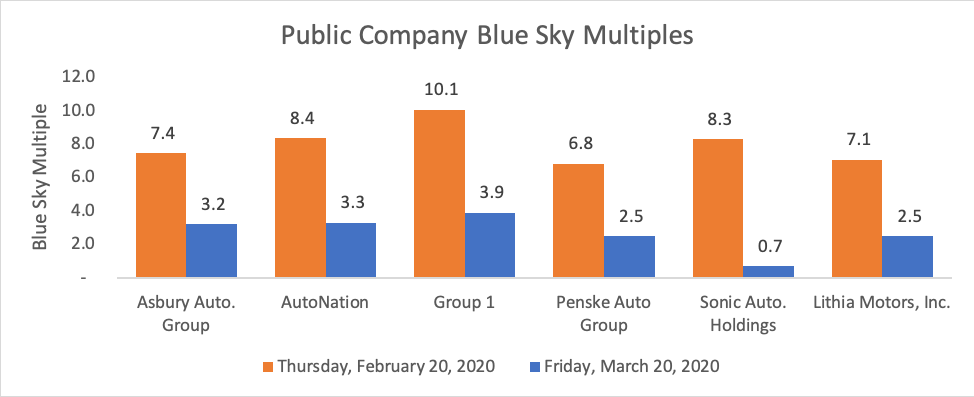

Right now, the value of an automobile dealership, as measured by the public markets, is less than 50% of what is was only one month ago. We at Bel Air estimated the blue-sky values of the public companies, both as of last Friday and as of one month ago, based on 2019 earnings. As you can see from the chart below, the declines have been shocking. Companies that own some of the most highly regarded dealerships in the nation are selling at about 3x Bel Air’s estimate of blue sky. In contrast, just three months ago, Asbury Automotive announced their intention to purchase a collection of premium dealerships, paying at least 10x blue sky. (Today, Asbury announced the termination of the acquisition.)

But this is only the beginning to a movie we have seen before. On October 9, 2007, just prior to last crash, the Dow Jones Industrial Average (“DJIA”) hit its then historic high. At that time, it would have cost $138.89 to purchase one share in each of the six public dealership companies. On October 23, 2008, it would have cost $24.26 to purchase those same six shares, an 83% decline in value. Some of the public dealership groups were priced like they might go out of business. The auditors of both Asbury and Sonic questioned as to whether these two companies could continue as “going concerns”. On October 27, 2008, Asbury and Lithia shares fell to $2.05 and $1.55 per share, respectively. Even after the recent declines, these shares are valued at $50.60 and $80.33, respectively (as of March 23, 2020).

Car dealers, however, came back with a vengeance. One year later, those same shares in those same public companies would have cost $110.36, a 355% gain, as compared to a 15% gain for the DJIA. Five years later, on September 23, 2013, that $24.26 investment would have risen to $291.48, a gain of 1,100%. In contrast, the DJIA rose 77%. Public dealership values hit a peak last December when this basket of shares would have cost $535.64, a gain of 2,100%.

It may be time to buckle the chin strap and move down the field, but there is also potentially an opportunity to take advantage of this moment and save on your taxes. Estate planning often requires a valuation and the blue-sky values of the public dealership groups have come down dramatically. We at Bel Air rely on public company valuations in our work.

Please contact us if we can assist.

- Sophisticated Financial Advice

- Preeminent Strategic Advisors

Contact Us

9174 Highland Ridge Way

Tampa, FL 33647